Tripcatcher requires a subscription, you must have a Tripcatcher web account to use this app. Your employer, accountant or bookkeeper may provide you with a free Tripcatcher web account.

Capturing your business mileage is now even easier. Tripcatcher calculates your mileage expense, keeps track of your mileage (important for the HMRC 10,000 miles threshold), and updates your online mileage expenses at Tripcatcher, where they can be published to Xero, Receipt Bank, Expensify and Crunch.

Features

- Calculates your mileage expense based on HMRC mileage rates;

- Keeps track of your mileage travelled by car or van (to enable the rate to change at 10,000 miles);

- Suitable for use by cyclists and motorbike riders;

- Calculates the journey distance using Googles mileage calculator;

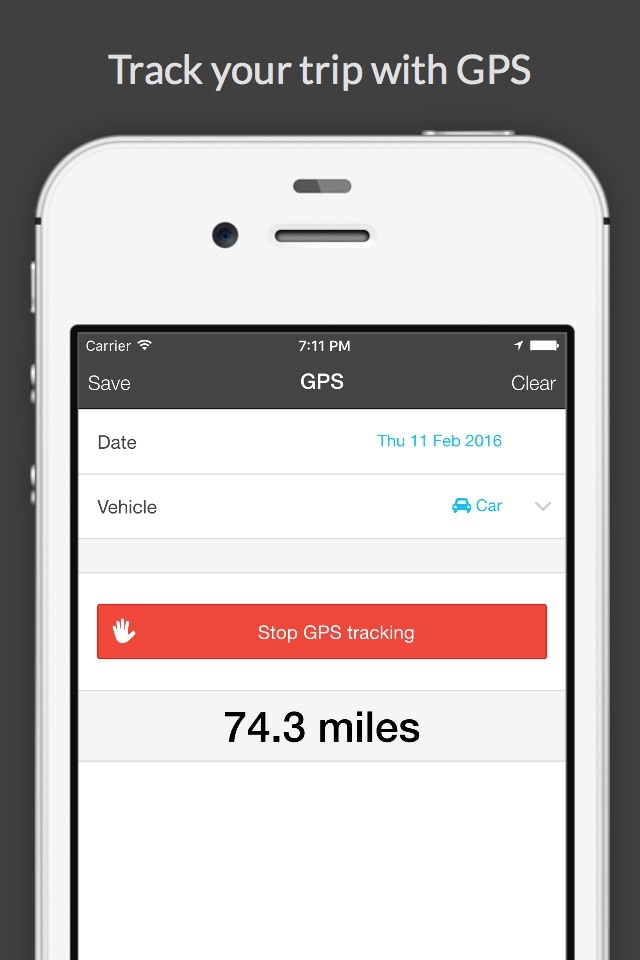

- Use GPS to measure the trip mileage;

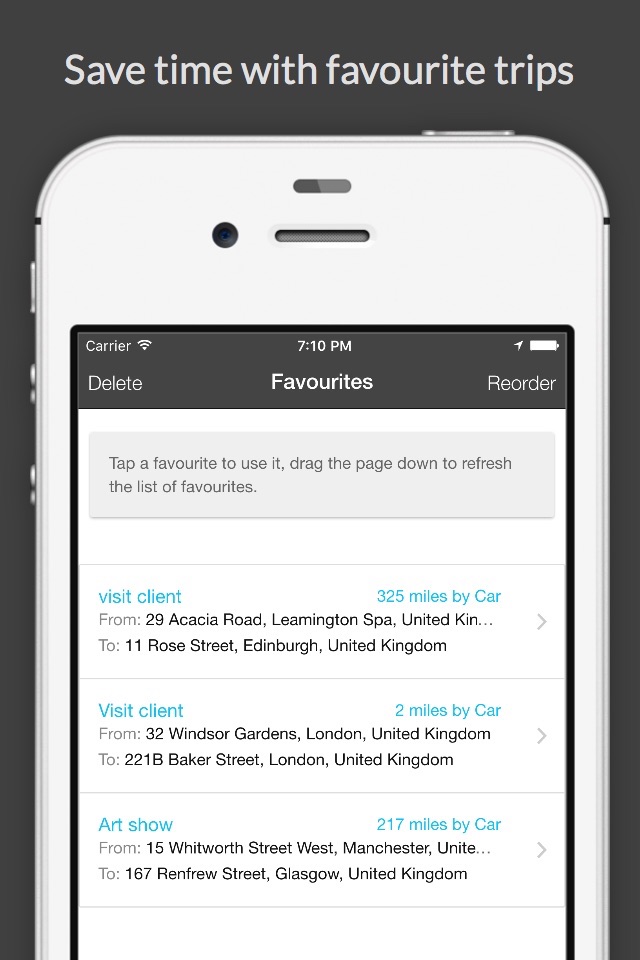

- Favourite trips and defaults save you time when entering your trip details.

Requirements

Needs a Tripcatcher web account.

Note

Continued use of GPS running in the background can dramatically decrease battery life.